Since founding Colobus in 1999, Chris Lowe, Principal, has worked with many businesses to improve their cashflow, growth and profits. His team have helped clients overcome failures, missteps and recessions to grow and prosper, working across a range of sectors and sizes, including many small and medium-sized enterprises. The key difference was that Chris looks at things from the other-party’s point of view and is able to build trust and reach better agreements.

Chris was asked by Angus, CEO, Chairman and investor to financially appraise the acquisition of a manufacturing business valued by the vendor at £18M. Having completed financial due diligence and following discussions with the local management team, he was able to get a picture of business potential and its face value. However, as it was a manufacturing business, Chris recognised that many important factors would not be revealed by a financial analysis alone so he contacted OAG to conduct an assessment of Operations.

To conduct an on-site assessment of operations as an aid to valuation and decision making.

A four-day onsite Spearhead assessment was led by an OAG licenced consultant. It captured input from the MD, FD and Operations Director. After the revenue, cost of sales and component improvement data was entered, the senior team was allocated a unique code to enable them to access the assessment and record their scores for the current situation and to give their opinion on aspirations for each of the 7 key components and their sub-components. An OAG coach was on hand to brief them on the assessment process, help with gathering and validating evidence appertaining to the current situation and to guide individuals with its completion. OAG’s findings were presented to Angus and Chris.

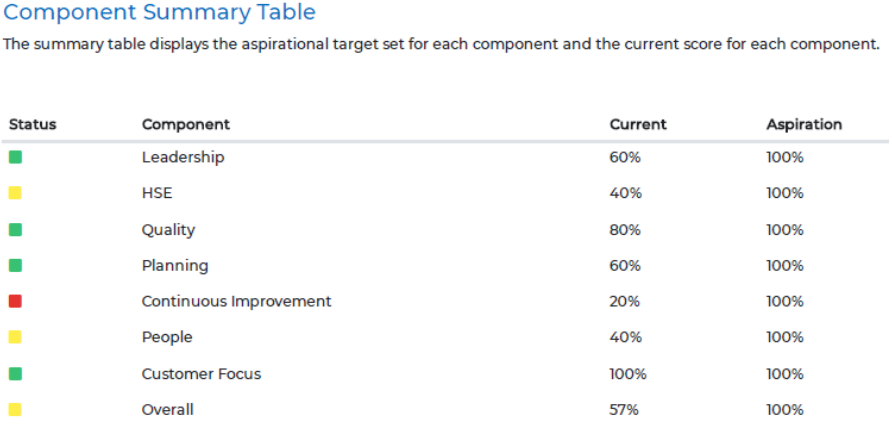

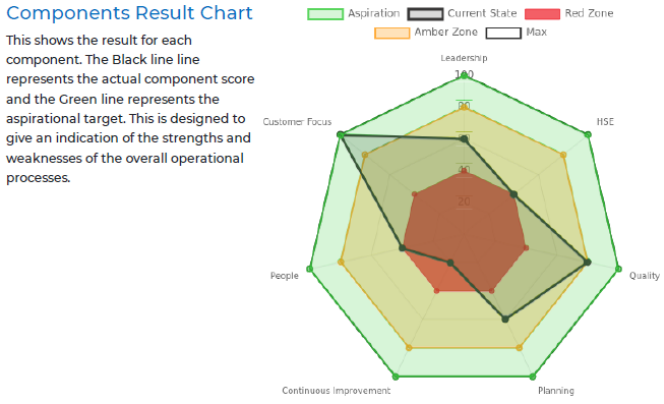

The overall assessment result has positioned the operation within the Amber zone. This indicates that each of the components has achieved a standard that will maintain the business at current performance levels and are sufficiently developed to control operating costs and meet customer expectations in the short term. However, in four of the seven components there were major areas of risk which would need significant and immediate investment.

The leadership team works well in the current situation, but was very reliant on two key individuals including the MD. Both were aging and would have had to being incentivised to remain in the business.

There was no succession plan and the important roles were filled with people rapidly approaching retirement. The business paid its workforce well under the going rates for skilled people and the catchment area for the required skills reached beyond a reasonable commuting distance. There was no apprenticeship or internal training scheme. Many of the key processes required skilled people and to automate them would cost in the region of £6M.

Two major concerns were identified regarding dangerous working practices, which if not addressed could result in a major accident and possible fatality thereby putting the company at risk of a prohibition order. Our estimate for the cost of resolving them exceed £250k and would take 6 months to install. Moreover, the culture change investment necessary to prevent similar occurrences in the future would involve education, equipment and a change of operational leadership. Our estimate for this was £1.5M over 1 year.

This component scored by far the highest in the assessment, however, the excellent customer relationship has been created over many years by the MD who stated that he wanted to consult in design alone or leave. As relationships are key to developing long term contracts, particularly in the Middle East, any change could threaten sales significantly.

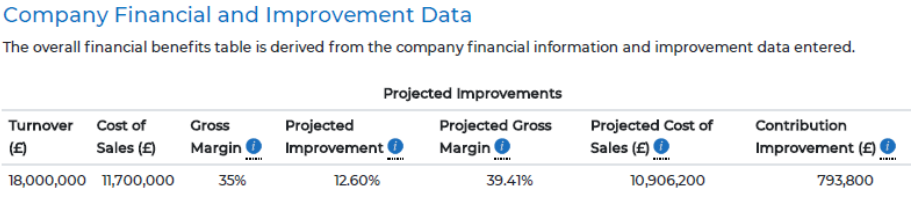

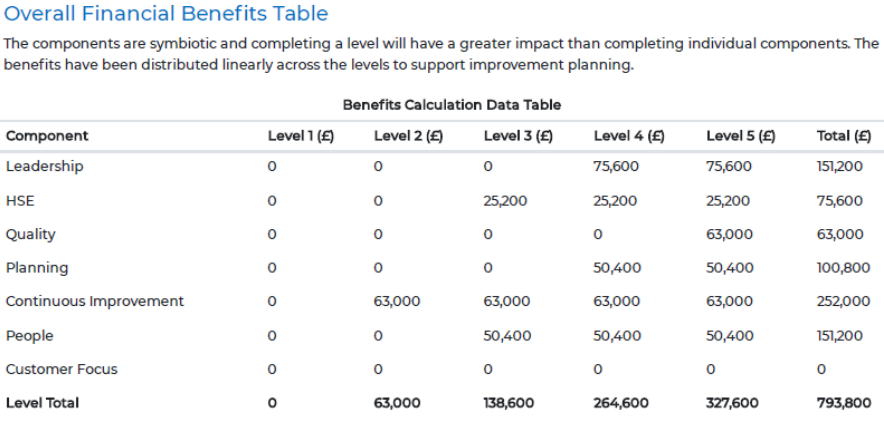

Closing the gap between current state and the business aspirations has financial and cultural benefits. Here is an extract of the current overall results and projected financial opportunities.

A full presentation and discussion of the findings was done on the next working day with a follow up one week later. As a result of the presentation, discussion, executive summary and the 22-page report, the investor decided to make a revised offer which would enable the reparations to be done.